estate tax exemption 2022 build back better

Which allows a surviving spouse to use his. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to.

Latest Update On The Build Back Better Act For Estate Planners Wealth Management

The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million.

. The Build Back Better bill passed in the House of Representatives on November 19 2021. If your system was installed between 2006. This includes the following.

Gift and Estate Taxes Proposed Under the Build Back Better Act. If your solar panels were installed after January 1 2022 you may qualify for the newly increased 30 tax credit under the Inflation Reduction Act. Effective January 1 2022 the BBBA reduces the gift estate and GST tax exemptions from 11700000 per person.

8 hours agoRELPs afford partners a level of purchasing power that would be out of reach of each of them individually with the potential for some incredibly high returns. President Bidens Build Back Better Bill is still being drafted in Congress. Understanding Other Proposed Changes Under the Build Back.

In short the proposed Build Back Better Act BBBA does the following. ANCHOR payments will be paid. The federal estate tax exemption is currently set at 10 million and is indexed for inflation.

The Build Back Better Act was passed by the House of Representatives on November 5 2021 and is headed for the Senate. The federal estate tax exemption amount is still dropping on January 1 2026 from. Lowering the gift and estate tax exemptions seems a lock.

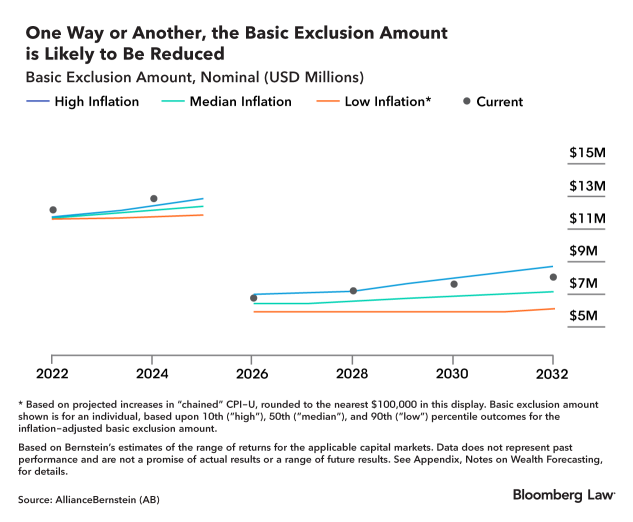

In 2026 the exemption is predicted drop to about 660 See more. The Estate Tax Exemption and Current Build Back Better Legislation Headlines indicate President Biden will be signing the Infrastructure Investment and Jobs Act on Monday. Meanwhile the IRS has released its 2022 annual adjustments to various tax provisions.

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. PISCATAWAY NJ The Better Safer Schools Team has three highly qualified candidates running in the November 3rd General Election for seats on the Piscataway Board of Education. We will begin paying ANCHOR benefits in the late Spring of 2023.

The federal estate tax exemption for 2022 is 1206 million. The deadline for filing your ANCHOR benefit application is December 30 2022. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for.

The prior version of the Build Back Better bill included an acceleration of this reduction of the exemptions to January 1 2022. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Build Back Better Act Estate Tax Exemption.

A reduction in the federal estate tax. 2022 c21 establishes a Sales Tax Holiday for certain retail sales of computers school supplies and sport or recreational equipment when sold to an individual. The exemption will increase with inflation to approximately 12060000 per person in 2022.

The BBBA proposal seeks to reduce these. In late october the house rules committee released a revised version of the proposed build back better act reconciliation bill.

What S Happening With The U S Estate And Gift Tax O Sullivan Estate Lawyers Toronto On

The Estate Tax And Lifetime Gifting Charles Schwab

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Estate And Gift Tax Laws In 2022 And The Build Back Better Act

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Four More Years For The Heightened Gift And Tax Estate Exclusion

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Inheritance Tax Here S Who Pays And In Which States Bankrate

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Build Back Better Act Trusts And Estates

Irs Announces Increased Gift And Estate Tax Exemption Amounts Morgan Lewis Jdsupra

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

More Families Can Now Take Advantage Of A 24 12 Million Portable Estate Tax Exemption Waller Lansden Dortch Davis Llp Jdsupra

Don T Throw Away A 12 06m Estate Tax Exemption By Accident Kiplinger

2022 Tax Reform And Charitable Giving Fidelity Charitable

Four More Years For The Heightened Gift And Tax Estate Exclusion

The Effects Of The Build Back Better Act On Estate Planning

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities